Tornado damage can be a disastrous situation to deal with. If you suffered from a tornado then you know first-hand and the chaos that can occur. It can be hard to know where to start when your property has been completely demolished.

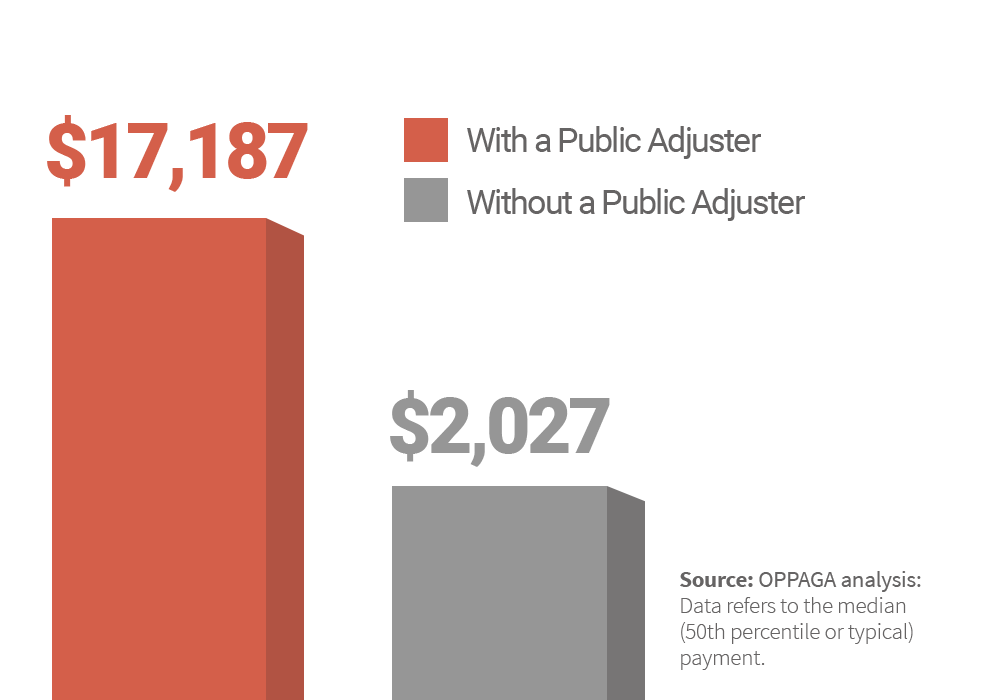

Having an expert by your side can make the process much more successful and remove the stress of having to file all the various documents with your insurance company. One of the challenges with a totally destroyed property is preparing documentation of all your belongings. Not only do you have to list everything you have lost, but you must also prove reasonable value to the insurance company. Hiring a public adjuster and taking simple preventive measures can greatly increase the success of your claim.

Ways to protect yourself from loss: