Water & Flood Damage

Home / How We Can Help/ Water & Flood Damage

Flood and water damage are often seen as similar, however they are classified as completely different perils. They can both require unique steps in filing and often the biggest challenge is properly categorizing the loss.

Water damage is one the most common types of claims and in the top three for costs to repair. Damage to your property by water can be extensive and cause long term effects if not properly mitigated. Failing to properly repair after this type of loss can often lead to your insurance company denying you compensation for future damages. This is why its important to have an expert on your side to thoroughly inspect your properly and help take measure to prevent further damage.

Water Damage Can:

-

Warp flooring, tiles and wood

-

Stain your ceiling and walls

-

Promote Harmful Mold Growth

-

Cause lasting damage to building structure

Flood and water damage are often seen as similar, however they are classified as completely different perils. They can both require unique steps in filing and often the biggest challenge is properly categorizing the loss.

Water damage is one the most common types of claims and in the top three for costs to repair. Damage to your property by water can be extensive and cause long term effects if not properly mitigated. Failing to properly repair after this type of loss can often lead to your insurance company denying you compensation for future damages. This is why its important to have an expert on your side to thoroughly inspect your properly and help take measure to prevent further damage.

Water Damage Can:

- Warp flooring, tiles and wood

- Stain your ceiling and walls

- Promote Harmful Mold Growth

- Cause lasting damage to building structure

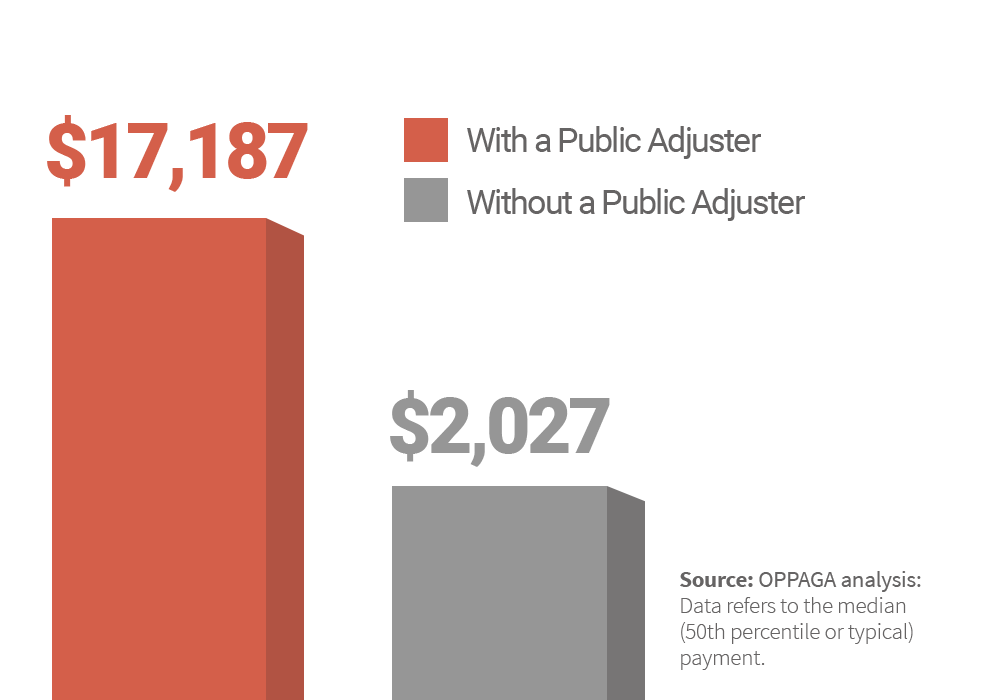

On average hiring a public adjuster to help settle your claim can increase the payout over over 500%.

We can Maximize your claim

A public adjuster can be your greatest tool to maximize your insurance claim and protect your rights during a time of a loss.

We are your advocate to obtain the maximum settlement for any type of insurance claim. The insurance company's adjusters and the "independent" adjusters are hired by your insurance company to solely represent their best interest; the adjuster's duty to his employer (the insurance company) is to limit the insurance payout, meaning you get less than what your entitled to. At Stronghold Adjusting, we work only for you and we manage every phase of preparing and presenting your insurance claim properly to insure you get everything you deserve covered under your insurance policy.

FAQ

Request Free Claim Review

Fill out the form below and one of our licensed public adjusters will contact you.