Smoke Damage

Home / How We Can Help/ Smoke Damage

Fire is almost always followed by smoke damage. Smoke contains hydrochloric acid which is very corrosive. If left unchecked it can be very damaging long term to a structure. Additionally, heat from the fire builds pressure and pushes smoke into further locations and can have a surprising area of effect. Properly inspecting and defining the scope of damages can greatly increase your claims payout.

The process of restoring your property after smoke damage can also be an important step in your claim. Often policies state that if you fail to properly prevent further damage within reasonable means then they can deny your claim. A public adjuster can help you coordinate all the necessary steps through the claims process and ensure your assets are protected and you get the full coverage of your policy.

Smoke Damage Can:

-

Lessen Life of Mechanical and Electronic Equipment

-

Reach Remote Locations Often Overlooked

-

Cause Corrosive Long Term Damage

Fire is almost always followed by smoke damage. Smoke contains hydrochloric acid which is very corrosive. If left unchecked it can be very damaging long term to a structure. Additionally, heat from the fire builds pressure and pushes smoke into further locations and can have a surprising area of effect. Properly inspecting and defining the scope of damages can greatly increase your claims payout.

The process of restoring your property after smoke damage can also be an important step in your claim. Often policies state that if you fail to properly prevent further damage within reasonable means then they can deny your claim. A public adjuster can help you coordinate all the necessary steps through the claims process and ensure your assets are protected and you get the full coverage of your policy.

Smoke Damage Can:

- Lessen Life of Mechanical and Electronic Equipment

- Reach Remote Locations Often Overlooked

- Cause Corrosive Long Term Damage

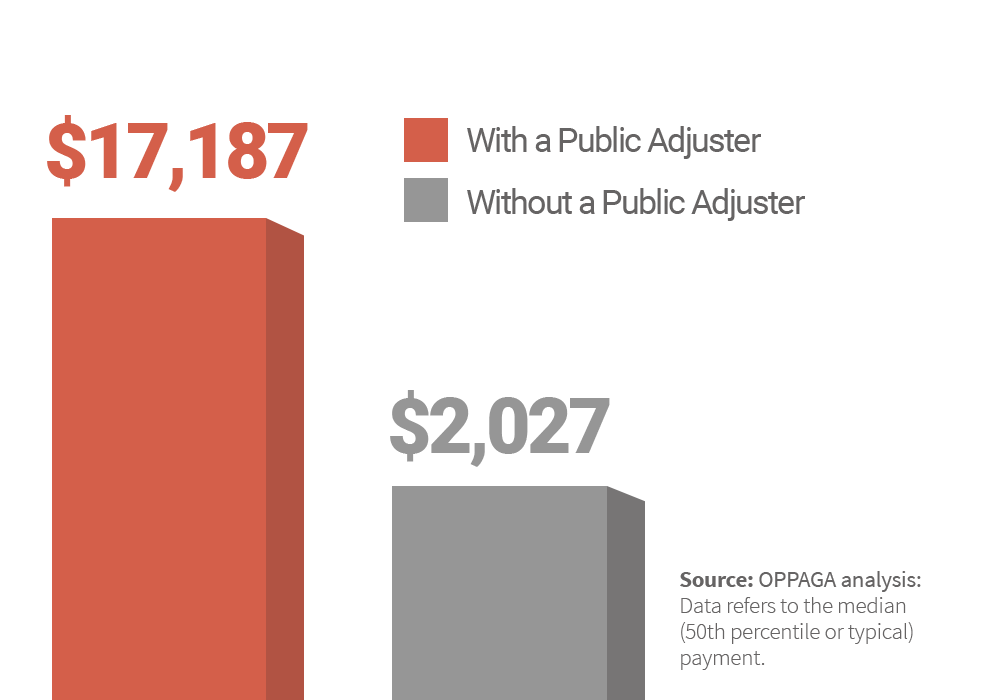

On average hiring a public adjuster to help settle your claim can increase the payout over over 500%.

We can Maximize your claim

A public adjuster can be your greatest tool to maximize your insurance claim and protect your rights during a time of a loss.

We are your advocate to obtain the maximum settlement for any type of insurance claim. The insurance company's adjusters and the "independent" adjusters are hired by your insurance company to solely represent their best interest; the adjuster's duty to his employer (the insurance company) is to limit the insurance payout, meaning you get less than what your entitled to. At Stronghold Adjusting, we work only for you and we manage every phase of preparing and presenting your insurance claim properly to insure you get everything you deserve covered under your insurance policy.

FAQ

Request Free Claim Review

Fill out the form below and one of our licensed public adjusters will contact you.