Emergency Storm Services are Currently Available!

Residential Property Damage

Residential Property Damage

First thing to do when your residence is damaged is call us first! We have expert Public Adjusters standing by to help you now! Calling us before trying to fix anything yourself can help save you thousands of dollars in repairs. Stronghold Adjusting negotiates with the insurers to get the cash you deserve. Contact us today and get the help and expertise to restore your damaged personal belongings.

Stronghold Adjusting coverage protects your dwelling which includes the residence premises and attached structures. Coverage extends to supplies and materials located on or next to the residence premises. The material must however be meant for the means of constructing or modifying the residence. Land is not covered. Other structures on the insured premises are also covered if they are separated from the dwelling. Coverage is not provided for structures such as garages, sheds, or storage buildings if they are used in whole or part for business. There may be an exception for structures that may be rented as a private garage. Personal property that would also be damaged on the residence premises is covered. Coverage may even extend to a guest or residence employee if that property had been damaged at the residence premises occupied by the insured.

Additional Loss Coverages We Can Help With:

- Debris Removal

- Reasonable Repairs

- Trees, Shrubs and Other Plants

- Fire Department Service Charge

- Property Removed

- Credit Card, Fund Transfer Card, Forgery, and Counterfeit Money

- Loss Assessment

- Glass or Safety Glazing Material

- Landlord's Furnishings

Service Areas

- Jacksonville, Florida

- Miami, Florida

- Tampa, Florida

- St. Petersburg, Florida

- Ocoee, Florida

- Orlando, Florida

- Hialeah, Florida

- Tallahassee, Florida

- Fort Lauderdale, Florida

- Pembroke Pines, Florida

- Cape Coral, Florida

- Tallahassee, Florida

- Gainesville, Florida

- Palm Bay, Florida

- Miami Beach, Florida

- And more...

Contact

- 1404 Hamlin, Unit M1, Saint Cloud, Fl 34771

- +(815) 669-0111

- claims@strongholdadjusting.com

- Contact Us

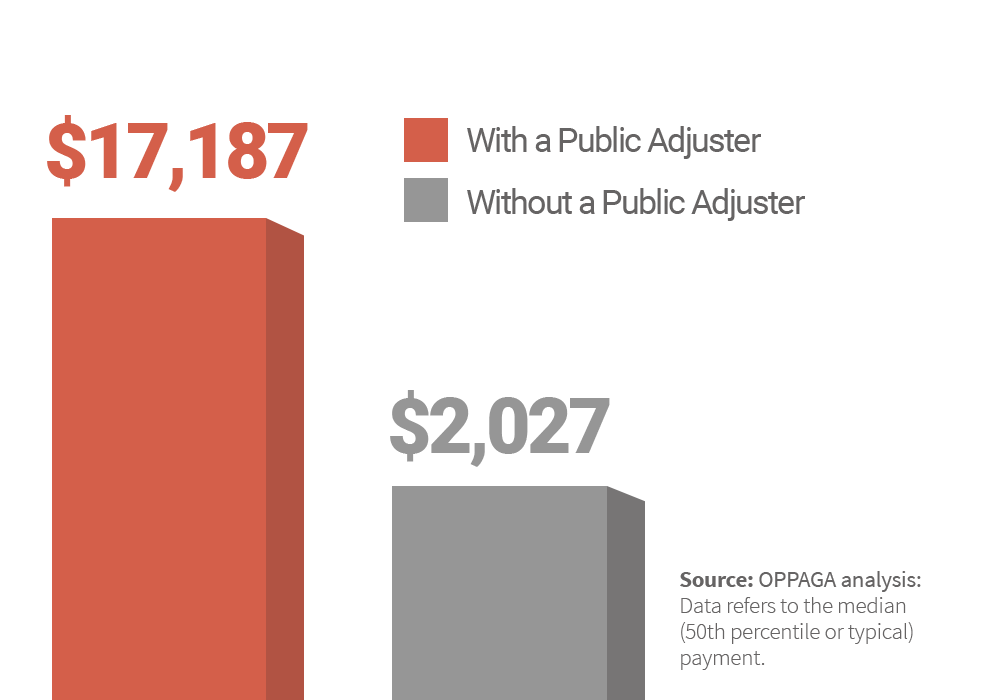

On average hiring a public adjuster to help settle your claim can increase the payout over over 500%.

We can Maximize your claim

A public adjuster can be your greatest tool to maximize your insurance claim and protect your rights during a time of a loss.

We are your advocate to obtain the maximum settlement for any type of insurance claim. The insurance company's adjusters and the "independent" adjusters are hired by your insurance company to solely represent their best interest; the adjuster's duty to his employer (the insurance company) is to limit the insurance payout, meaning you get less than what your entitled to. At Stronghold Adjusting, we work only for you and we manage every phase of preparing and presenting your insurance claim properly to insure you get everything you deserve covered under your insurance policy.